Retirement Calculator Jp Morgan

All of us want to live the nice live we dream of after we retire. Logon authenticationerrorMessage translateauthenticationerrorMessageParams logonlogonTitle translate.

Building Better Retirement Portfolios J P Morgan Asset Management

The calculation is based on the NAVs as at the selected Monthly Investment Date within your selected Start Date and End Date.

Retirement calculator jp morgan. If you own a retirement account and reach 70 years old. Investment Date Original Shares Original Value Current Shares Current Value Percent Return. Use this tool to estimate the quarterly and annual fees charged on your mutual fund investment.

Accumulated market value as of the selected End Date NAV x Accumulated Units x FX Rate. You can delay taking your first RMD to April 1 of the year following the year you turn 70. Morgan Asset Management name.

Also explore many more calculators covering retirement finance math fitness health and numerous other topics. Retirement Plan Tools Resources. If the IRA holder turns 72 this year he or she can defer the first distribution until April 1 of the next year.

For example if your employer offers a two-tiered program with a 100 match on contributions of up to 3 plus a 50 match on contribution amounts over 3 up to a maximum of 6 enter 100 on 3 as the 1st Tier and 50 on 3 as the 2nd Tier. First you invest a portion of your assets in a JP Morgan SmartSpending fund. The calculator uses the annual fund operating expenses after fee waivers and expenses reimbursements as reflected in the applicable Funds most recent prospectus.

For help with JP. But be mindful that you. Please review its terms privacy and security policies to see how they apply to you.

Morgan ETFs are distributed by JPMorgan Distribution Services Inc which is an affiliate of JPMorgan Chase. The answer to this question may help determine what your retirement lifestyle might be. Retirement calculator jp morgan.

The Commingled Pension Trust Funds of JPMorgan Chase Bank NA. We all know that it is very important to plan our retirement it doesnt matter what age you are or what you line of work is. At 1-800-480-4111 or download it from this site.

To use this calculator please input your account balance. Does your employer offer a matching contribution. Many 401 k loans charge one to two points above the prime interest rate.

Generally you can only borrow up to 50 of your vested account balance up to a maximum of 50000. They can estimate how much to save how much is withdrawable and how long savings can last in retirement. Call 1-844-4JPM-ETF or download it from this site.

Contact JPMorgan Distribution Services Inc. Use our retirement calculator to determine if you will have enough money to enjoy a happy and secure retirement. Based on your input data for fund name investment amount and investment period the Investment Calculator will immediately calculate the return for you.

Morgan Funds and JP. Morgan isnt responsible for and doesnt provide any products services or content at this third-party site or app except for products and services that explicitly. But while a traditional 401k offers pre-tax contributions and permits you to defer taxes on gains until withdrawals begin a Roth 401k offers after-tax contributions and permits you to avoid taxes on gains and qualified withdrawals altogether if you meet certain age and.

Find out the power of compound interest and how it can help you build a fortune. Morgans website andor mobile terms privacy and security policies dont apply to the site or app youre about to visit. Its designed to help you make your money last through retirement even to age 100.

Free calculators that help with retirement planning taking inflation social security life expectancy and many more factors into account. Wealth Builder Retirement Calculator is a useful tool to help you calculate how much money you can have at retirement if you invest monthly in stocks IRAs or 401Ks. If the selected monthly investment date is not a valuation date price at the next valuation date will be used in the calculation.

Everything you need to build stronger retirement plansall in one place. Analyze and compare core menu investments. Morgan Asset Management isnt responsible for and doesnt provide any products services or content at this third-party site or app except for products and services that explicitly carry the JP.

Evaluate and select target date funds to find the funds most closely aligned with plan goals and participant needs. Generally annual RMDs must be taken before December 31 of each year. If so enter the appropriate percentage of match for your desired level of contribution.

To obtain a prospectus for Mutual Funds. Like a traditional 401k a Roth 401k lets you contribute a portion of your pay to help prepare for retirement. Next you check in each year to see how much to spend to keep your retirement on track.

Editorials Jp Morgan Retirement Plan. Whether you plan to live off a pension and Social Security personal savings or expect to tap into other income sources it. Please review its terms privacy and security policies to see how they apply to you.

How much income can you plan on in retirement. Your employer may have different plan-specific limits.

Principles For A Successful Retirement J P Morgan Asset Management

Young People Who Want To Have A Lot Of Money In Retirement Better Understand This Chart Ways To Get Rich How To Get Rich Saving For Retirement

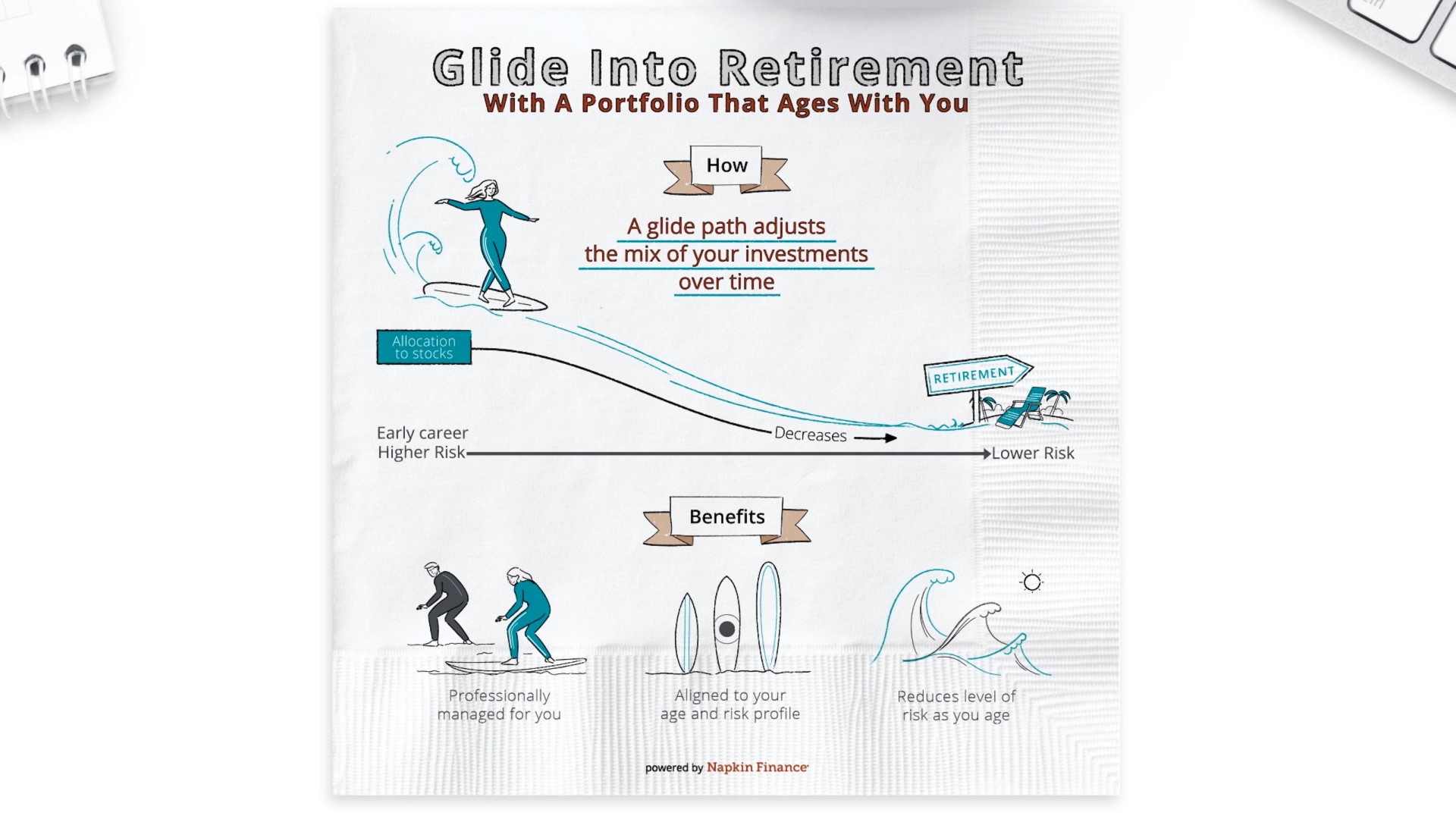

Glide Paths For Retirement Chase Com

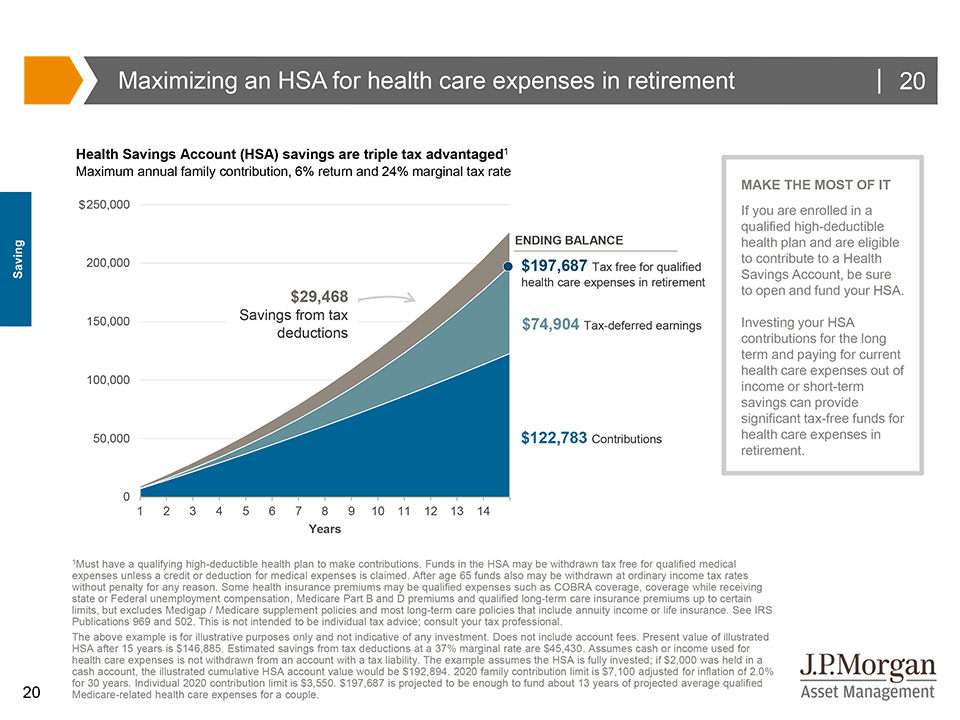

Health Savings Account Guide Does An Hsa Make Sense For You Health Savings Account Savings Account Accounting

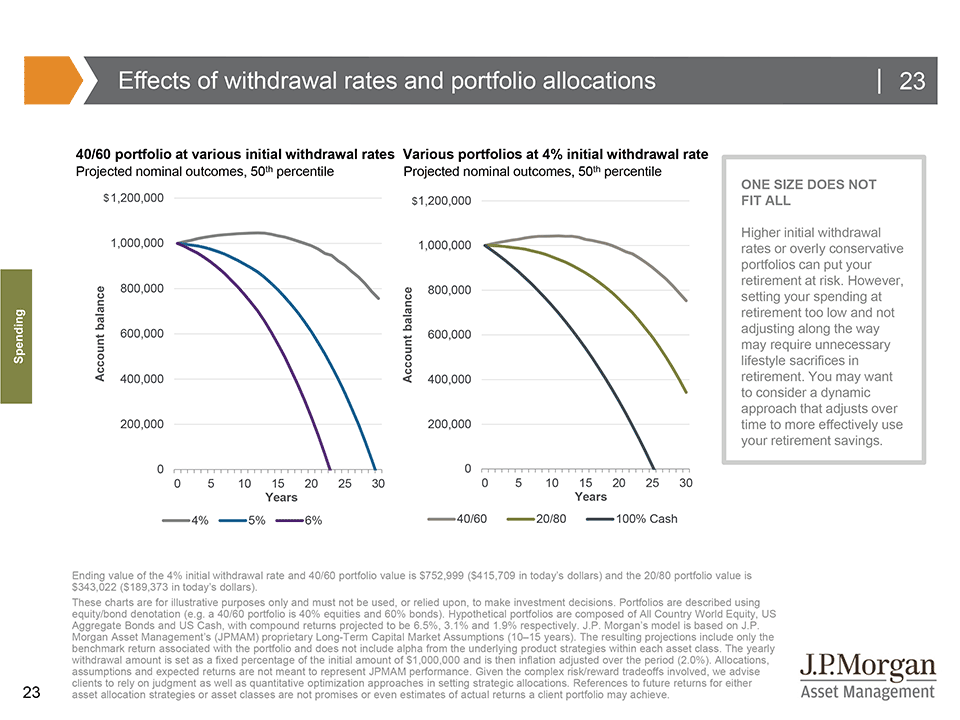

Building Better Retirement Portfolios J P Morgan Asset Management

Principles For A Successful Retirement J P Morgan Asset Management

Principles For A Successful Retirement J P Morgan Asset Management

Savings Factors To Help You On Your Journey To Retirement By Age 30 Have 1x Your Salary Age 50 4x And Age Saving For Retirement Retirement Budgeting Money

Principles For A Successful Retirement J P Morgan Asset Management

Interactive Print Slide Chart Style Grade Calculator Education Chart Interactive

What Drives The Stock Market Stock Market Education Center Investing

Is It Better To Have A 401 K Or An Ira Homework Space Retirement Savings Plan Silly Questions

Pin On Slide Charts Paper Sliders Pocket Sliders

Principles For A Successful Retirement J P Morgan Asset Management

Building Better Retirement Portfolios J P Morgan Asset Management

Pin On Accept Check With Best Tool With Real Time Verification

Posting Komentar untuk "Retirement Calculator Jp Morgan"