Salary Calculator Gross To Net Germany

Each year more than 4000 people emigrate from Germany to Switzerland. A minimum base salary for Software Developers DevOps QA and other tech professionals in Denmark starts at 30000 per year.

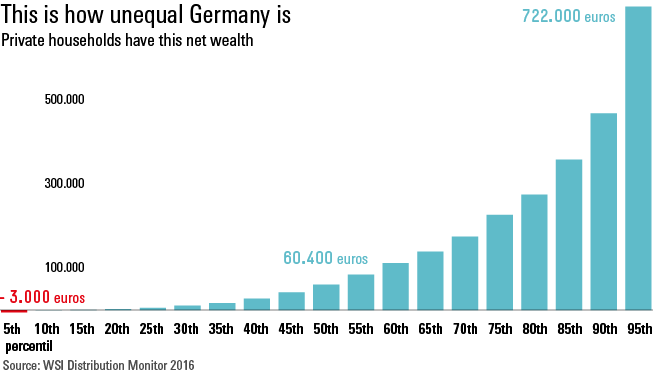

2 How Is Wealth Distributed In Germany Institute Of Economic And Social Research

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

Salary calculator gross to net germany. The average monthly net salary in France is around 2 157 EUR with a minimum income of 1 149 EUR per month. The tax class affects the rate of income tax solidarity surcharge and church tax. Program to calculate the Wage Tax for 2010-2016.

In a whole lot of countries when negotiations are made they focus on net monthly income. The gross to net salary in Germany is one of the biggest misconceptions that you will ever get in this country. Low taxes and a very high quality of life are just two of the many reasons.

A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year. Using the wage calculator from here I am getting monthly salary 263620 euros excluding extra. Unser Rechner wurde ausgiebig auf korrekte Funktionsweise berprft.

This should be enough to get a clear picture about the impact taxes may have on your income depending on how much you earn per months or year. These figures place Germany on the 12th place in the list of European countries by average wage. The German Hourly Income Tax Calculator for the 2021 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202122 and your net pay the.

With just a few mouse clicks you can calculate your salary accurately and optimise your income as much as possible thanks to amongst others the addition of. How to calculate taxes taken out of a paycheck. This places France on the 11th place in the International Labour Organisation statistics for 2012 after the United Kingdom but before Germany.

Find tech jobs in Germany. Salary calculator in minute Please enter your e-mail for calculate your salary I agree with providing my email address for the purposes of a regular quarterly receiving of the current salary comparison in accordance with the Principles of the personal data processing. The SteuerGo Gross Net Calculator lets you determine your net income.

Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc. Unlike most EU member states France does not withhold income taxes from the monthly income although social security contributions are. Get used to Gross annual salary.

Belgium has as well one of the highest levels of taxation in the world with the income tax brackets ranging from 25 to 50 percent. Up to 800 2013. I am trying to figure out what would be the net monthly salary after deducting all taxes and social contributions.

German Income Tax Calculator. I have been offered a position with gross salary 60788 euros payable in 14 months. Whilst in Germany is the complete opposite.

Germany is not considered expensive compared to other European countries the prices of food and housing being only slightly higher than the EU average. So gross salary for one month is 4342 euros. 1881 2257.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. Individual salaries can vary greatly from this figure as they are affected by factors such as age seniority industry experience working hours and geographical location. Lohncomputerch will help you.

The calculation of salaries however is difficult for immigrants and requires the consideration of a variety of criteria. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. Tax-Free Allowance from Tax card Euro.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. The German Tax calculator is a free online tax calculator updated for the 2021 Tax Year. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a specific net amount.

The average monthly net salary in Belgium BE is around 3 160 EUR with a minimum income of 1 593 EUR per month. According to the Federal Statistical Office of Germany in 2019 the average gross annual salary was 47928 euros or 3994 euros per month. The result is net income.

At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of 80000 without bonuses. The tool makes the reverse calculation and lets you know the estimated gross amount including costs. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

This places Belgium on the 8th place in the Organisation for Economic Co-operation and Development after Australia but before Austria. Our Tax Calculator App helps you easily calculate your net wage by breaking down the German tax system into parts. In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis.

How to calculate annual income. The figures are imprecise and reflect the approximate salary range for tech professionals in. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of.

Net Salary Gross Salary. Gross Net Calculator 2021 of the German Wage Tax System. You can enter the gross wage as an annual or monthly figure.

Calculating Gross Pay Worksheet Financial Literacy Worksheets Student Loan Repayment Consumer Math

German Wage Tax Calculator Expat Tax

Private Household Income Distribution In Germany 2019 Statista

Germany S Minimum Wage Is Barely Above The Poverty Line Business Economy And Finance News From A German Perspective Dw 01 01 2019

Tax Class In Germany Explained Easy 2021 Expat Guide

German Tax System Taxes In Germany

German Income Tax Calculator Expat Tax

Net Household Savings Rate In Selected Countries 2019 Saving Rates Savings Household

Payslip In Germany How Does It Work Blog Parakar

How To Submit A Tax Declaration In Germany N26 N26

Income Tax In Germany For Foreigners Academics Com

Your Bullsh T Free Guide To Taxes In Germany

Germany Reducing Taxes From 2021 More Netto Income For You Youtube

Vat Calculator How To Calculate Your Sales Tax Guide

German Hourly Salary Calculator 2021 22

German Tax Calculator Easily Work Out Your Net Salary Youtube

Posting Komentar untuk "Salary Calculator Gross To Net Germany"